July 1, 2023

Dear Partners,

Columbia Heights Partners, LP return for the 6 months ended June 30, 2023 was 80% compared to the S&P 500 return of 17%.

Table of Contents:

1) A Few Good Men

2) Top Gun 2

3) Peter Lynch on Taco Bell

4) Portfolio Positioning

5) Position Pipeline

6) Thoughts on Inflation

7) Artificial Intelligence

A Few Good Men:

“You don't want the truth because deep down in places you don't talk about at parties, you want me on that wall -- you need me on that wall.”

https://www.youtube.com/clip/UgkxcB9aQNeoxw0p3073NntgGcmRB7epc0QY

The line that stands out to me is ‘you need me on that wall’. That reminds me of holding stocks through the volatility of a year like 2022. It is not easy. Many managers will succumb to playing it safe either by hedging via options, shorting, diversifying excessively, solving for ‘Sharpe Ratio’ vs MOIC/IRR, buying bonds or sticking safe names with low volatility (irrespective of commensurate risk/reward).

Investing is a function of what you solve for. I am solving for highest return in terms of IRR and MOIC (Multiple on Investment Capital). I run concentrated, high conviction and volatile. It is not always fun, but as Jack Nicholson says, for highest returns, ‘You Need Me On That Wall’.

To get 30% compounded over 10 years (10x over 10 years) is not easy. I don’t think anyone has ever done it without 1-2 significant draw downs. There may be examples of firms that have done it. But, it is unclear to me if what they were doing was legal, had a real edge or an information advantage, excessive leverage or other regulatory arbitrage.

This is not to imply I am seeking volatility for its own sake. But imagine what the country would look like if there were no risk takers like Edison, Rockefeller, Steven Jobs and countless others. Also, one might argue that they were not actually taking excessive risk, and were actually good risk/reward investors.

The lines from ‘A Few Good Men’:

Col Jessup: I'll answer the question. You want answers?

LTJG Kaffee: I think I'm entitled to them.

Col Jessup: You want answers?!

LTJG Kaffee: I want the truth!

Col Jessup: You can't handle the truth!

Son, we live in a world that has walls, and those walls have to be guarded by men with guns. Who's gonna do it? You? You, Lieutenant Weinberg? I have a greater responsibility than you can possibly fathom. You weep for Santiago, and you curse the Marines. You have that luxury. You have the luxury of not knowing what I know -- that Santiago's death, while tragic, probably saved lives; and my existence, while grotesque and incomprehensible to you, saves lives.

You don't want the truth because deep down in places you don't talk about at parties, you want me on that wall -- you need me on that wall.

We use words like "honor," "code," "loyalty." We use these words as the backbone of a life spent defending something. You use them as a punch line.

I have neither the time nor the inclination to explain myself to a man who rises and sleeps under the blanket of the very freedom that I provide and then questions the manner in which I provide it.

I would rather that you just said "thank you" and went on your way. Otherwise, I suggest you pick up a weapon and stand the post. Either way, I don't give a DAMN what you think you're entitled to!

Top Gun 2:

Now to Top Gun 2. I like the scene when the plane has to fly on the steep angle up the mountain, down the mountain and at an even steeper angle and then pull up again to hit 10G on the wait out of the valley. This again, reminds me of January 1, 2023 and countless other market corrections over the last number of decades. The emotions are real and when you have stocks that trade down more than 50%, the feelings are similar.

https://www.youtube.com/clip/Ugkx4odD7AUupzMOQF5blMFd9hHSC3iCJQiN

Peter Lynch Quote on Taco Bell and Volatility:

Karmin: Are you concerned about the volatility in the financial markets today? Do you think something needs to be done to reduce it?

Lynch: I love volatility. I remember the market went down dramatically in 1972. Taco Bell went from $14 to $1. It had no debt. It never closed a restaurant. I started buying at $7, but I kept on it and it went to $1. It was the largest position in Magellan in 1978 when Pepsi-Cola bought it out at $42. It would have gone to $400 if Pepsi hadn’t bought it out. Volatility is terrific. These calls are important. I don’t think the market going up 80 points one day and down 80 the next is a good thing for the public. But I think all these callers and all these other things to keep the volatility down each day is important, but the market is going to go up and down.

Human nature hasn’t changed a lot in 25,000 years. Some event will come out of left field and the market will go down or the market will go up. Volatility will occur, and the markets will continue to have these ups and downs. That presents a great opportunity if people can understand what they own. If they don’t understand what they own, they can own mutual funds and keep adding to their mutual funds. Basic corporate profits have grown about 8% per year historically. Corporate profits double about every nine years. The stock market ought to double about every nine years, too. The market is about 3,800 today. I’m convinced the next 3,800 points will be up. It won’t be down. After that – the next 500 or 600 points – I don’t know which way they’ll go. The market ought to double in the next eight or nine years and double again in the eight or nine years after that because profits will go up 8%, then stocks will fall. That’s all there is to it.

Portfolio Positioning:

The portfolio has had very little turnover in more than a year. However, the listed prices have changed quite dramatically during that time. The portfolio has 6 positions. The current names are still very compelling. They were much cheaper on January 1, 2023 but still remain quite attractive.

I am encouraged that 5 of the 6 names (83% of the names) are deflating supply by buying back securities in the public markets. The last has a clear line of sight to capital returns via dividends or stock buybacks. I feel good with a portfolio where 83% of my companies are buying back stock! I only wish they would buy back more!

I am looking to target 5-20 names and recently I can honestly say that the market has presented 5-20 new names that may deserve a place in the portfolio. The dislocations across capital markets have been stark.

Position Pipeline:

The pipeline for positions is more robust than usual. I have a list of 10-30 names that could enter the portfolio. This quarter I expect to be more active. Markets seem to be past the worst volatility.

The pipeline includes securities that are distressed, asymmetric, uncorrelated, high dividend, high cash flow, high buybacks and high growth compounders. The list is quite broad. I will add some tickers (provided and redacted) below with a quick thesis. These names may or may not enter the portfolio. However, I might also track them to wait for them to get much cheaper.

Some of the names in the pipeline include a basket of Japanese net nets, Japanese semiconductor/AI supply chain names, *redacted* Asian Auto Supply Tech company in Hong Kong, *redacted* A Canadian legal software monopoly with pricing power, Silicon Valley Bank Bonds and Preferred Securities, Brookfield, Vornado, SL Green preferred stock, and *redacted* a global stock exchange, PBR-A, AMR, XPEL, EPSIL, A4L and a few other small caps. This list is relatively eclectic. I am not sure any enter the book, but I would like to give prospective investors a sense that I try to research a lot and cast a wide net. Many of these are optically cheap, but don’t meet the quality threshold and could result in excess tax liabilities or inefficiencies, small TAM or shorter duration long term compounding potential. Often, I end up concluding I like what I own now better. I say no a lot.

Legal Software Business

*Redacted* bought back 20% of the stock and then just bought 2.5% more. The stock is 5-10x EV/EBITDA where similar software businesses sell for 20-30x EV/EBITDA. The management is shareholder oriented and the product has monopoly pricing power. This business is closest to the 50/50/50 framework with high quality, pricing power where customers don’t directly pay for the software or pricing is masked and it represents a very small expense in a much larger transaction. However, the drawbacks are a smaller TAM in a smaller country, excessive debt and some key man management risk.

Asian Auto Supply tech Company

This company makes a critical component for cars and EVs. The cost of its equipment is critical and amortizes to $20 per car. That is $20 on a car that costs $20-80k. I think the company has a long runway for growth as the world transitions to EVs. Company sells at 10x PE, is run by and owner/operator and has capacity expansion plans that imply a forward PE closer to 3x. The market penetration of its TAM is near 1%, but long term has the potential to be 40-60%. 10x PE with 1% of its potential market penetration is quite interesting to me. I like this business a lot but am cautious about the Asia location and capital expenditures.

A Global Stock Exchange

This stock exchange trades at 20x PE, grew earnings last 3 years at 40%, 40% and 80%, may have a catalyst/IPO in next 2 years and is a monopoly in its local market. This company reminds me of Petrobras, China Tobacco and Philip Morris in that it also generates significant tax revenue for the government, which can sometimes be a moat and a positive. This one is very close to the 50/50/50 framework with 5 year revenue CAGR above 37%.

Inflation:

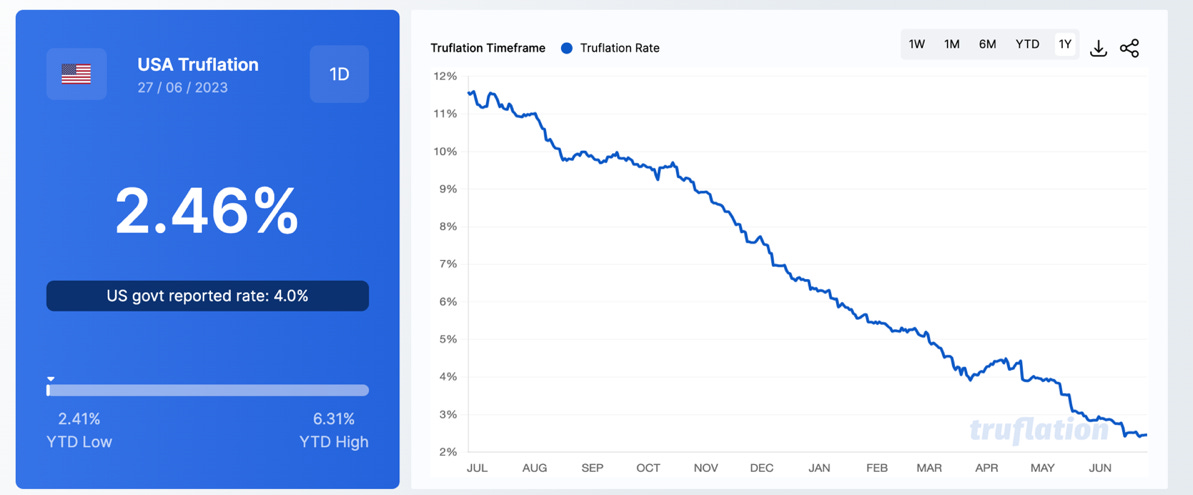

I did not have a high desire to comment on macro and inflation in the last few letters, but I thought to share my opinion (at the risk of being proven wrong). I was proven right that the 9-12% inflation would come down. I have been using Truflation data. I think the Fed is wrong. I think inflation will cool and we may see deflation (partly driven by aging populations in the OECD and Technology Innovation/AI).

Truflation:

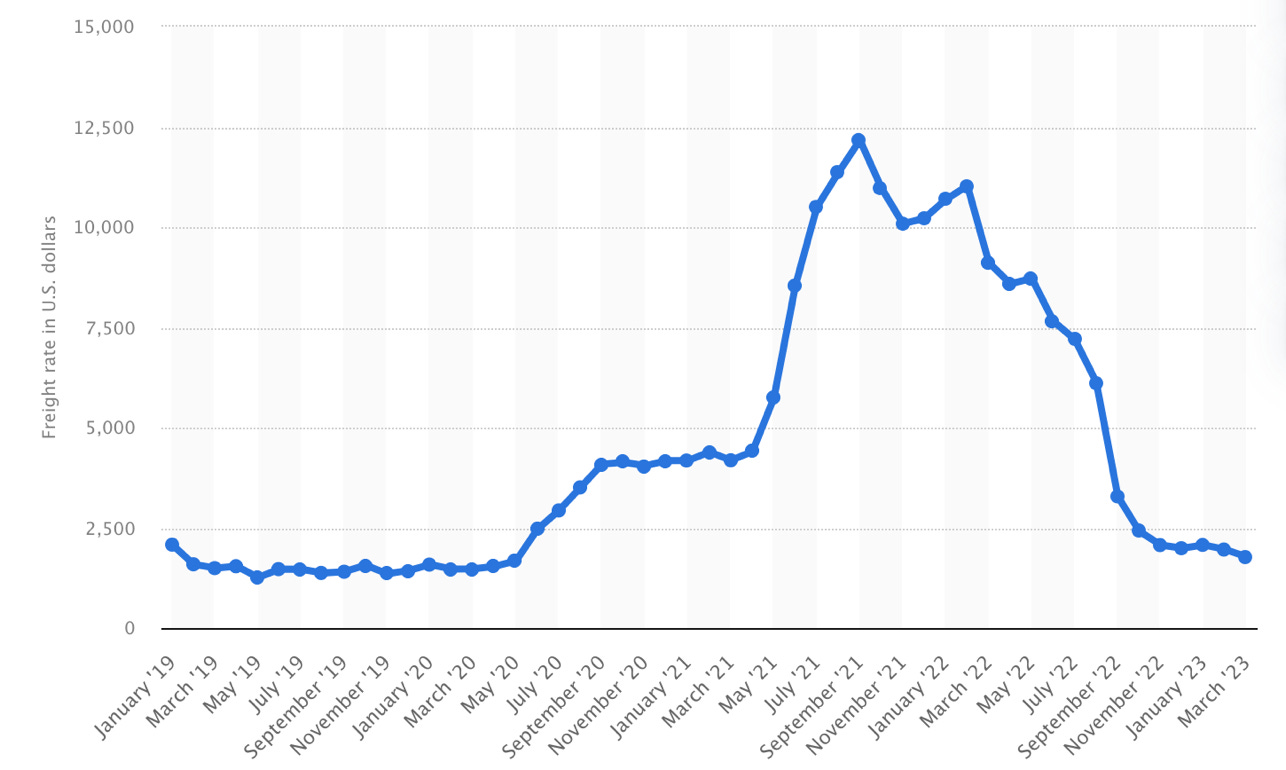

Container freight rate index from Shanghai to Los Angeles from January 2019 to March 2023(in U.S. dollars):

Artificial Intelligence:

The new developments in artificial intelligence are exciting. I have begun to do some research on the sector including sourcing two private deals with blue chip/high profile backers as well as digging deeper on the implications to TSM, ASML, AMD, OpenAI, NVDA, MSFT, ADBE, GOOG and others. Currently, I am comfortable that AI is priced in as a call option with some of the current positions and happy to discuss more.

The developments in AI are clearly very exciting and we are still at the very early stages. I think not much will happen over the next year, but a lot will happen over the next 5-30 years. I am also trying to understand if the value will accrue to the chip makers, software providers or service companies. Likely all 3.

The Nvidia earnings guidance beat was a surprising event and might mark the beginning of the new 2020’s bull market. The size of the beat was larger than many of us have ever seen. I am trying to research if Nvidia’s edge is long term and sustainable or competition is at their heels. Part of their edge is a software moat, but I need to diligence more.

It is still hard to know which of the players in AI will the Lycos, NetScape, AltaVista, Excite.Com, Yahoo, AOL of the AI era (losers) and which will be the Apple, Microsoft, Google, Amazon and Facebook of the AI era (winners).

Concluding Thoughts:

Thank you for your continued support and please refer any investors.

Columbia Heights Partners LP is open and capacity is also available.

Veda Global LP is open and capacity is also available.

Veda Global LP (the India Fund) owns India based financial monopolies with ROE in excess of 50% and Veda Global LP is also up almost 20% YTD.

Gorav Khanna

Managing Partner

Columbia Heights Partners, LP

Book List:

I have mentioned these books in the past, but they deserve a mention again! They are all *Excellent* and I am doing my best to reread them. Will and Ariel Durant are a treasure.

The Warburgs by Ron Chernow

The Anarchy by William Dalrymple

The Story of Civilization by Will Durant

The Lessons of History by Will Durant and Ariel Durant

He grabbed me on 'A few good men'!

Congrats on the 80%, thats is seriously solid.